First of all, we would like to talk about Calls and Trade Charges:

The clauses for the same are as follows:

- A minimum buy/sell order value of 1000/- (only in cash segment) will only be accepted as an order.

- SBICAP offers 30 calls free in a month after which Rs.10 (Plus Taxes) will be charged per call.

- Maximum 3 Scrips can be inquired per call

Along with these clauses, SBICAP security makes it very clear that these charges are applicable only for those calls that's received and attended by the calls & trade desk for placing a trade.

Secondly, we will throw light on Depository Service Charges. We want to explain to you, in short, the term "Depository Charges." DP charge is the amount that gets deducted from your DMAT account for selling any shares from your holdings. DP charges differ from broker to broker and SBICAPS has the following DP charges:

SBI Securities Account Opening and Brokerage charges

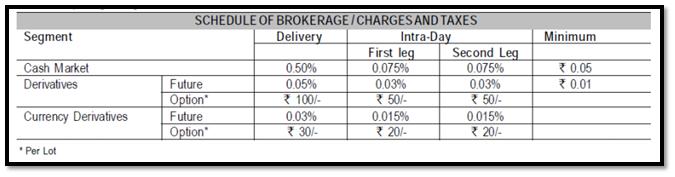

We have explained SBISmart - DMAT account opening charges earlier in this article and would like to tell in detail now. Account opening charges for an individual are RS 850/- plus KRA (as applicable), and for Non-individual it is RS 1000/- plus KRA (as applicable). Schedule of brokerage/ charge and taxes cash market, derivatives, and currency derivatives are mentioned in the chart below:

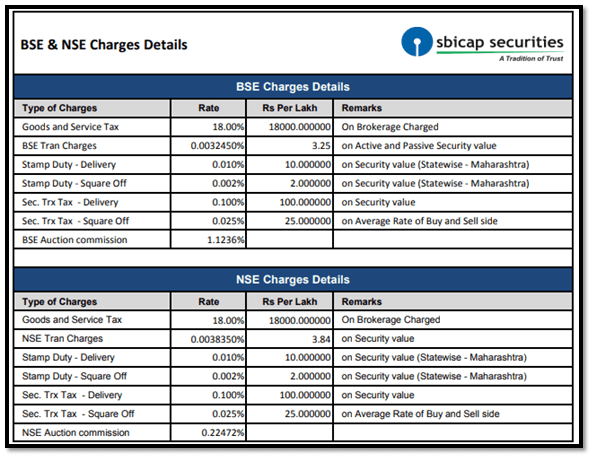

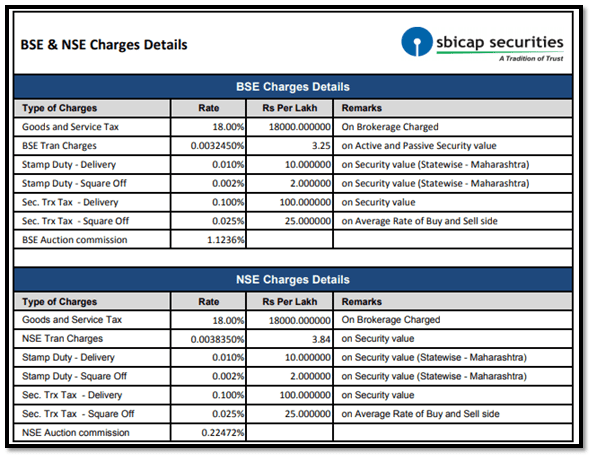

NSE and BSE charges with Taxes Bombay Stock Exchange and National Stock Exchange levies Goods and service Taxes of 18% but there Tran charges differ by 0.3% approximately. They charge higher for NSE though auction commission charges are higher for BSE trading.

SBICAP Securities Account Opening & AMC Charges

SBICAP Securities charges Rs 850 for the opening of a trading account with them and is the one-time fee charged while initiating your account opening process. Rs 350 are annual maintenance charges for a demat account and would get deducted from your account even if you have not traded for a year by SBICAP Securities to maintain your account.

SBICAP Securities Brokerage Charges

Please find below SBICAP Securities Brokerage charges in their basic Plan. SBICAP Securities provides delivery trade at 0.50%, Intraday Trade at 0.05%, Equity Future Trade at 0.05%, and Equity Option Trade at Rs 100 per lot.

SBICAP Securities Exchange Transaction Charges

The Brokers in India charges Transaction / Turnover charges along with Brokerage on every order executed through the stock exchange. These charges differ by the stock exchange in which you trade and type of trades like delivery, intraday or F&O, etc. SBICAP Securities Transaction charges are as per the below table:

SBICAP Securities Other Charges

A lot of other Charges are getting levied other than brokerage by SBICAP Securities like minimum brokerage, call & Trade charges, Stamp duty, DP Charges, etc. A list of the same is in the below table.

SBICAP Securities Demat Account Charges

The charges on Demat account transactions are charged separately and over and above trading Brokerage. Find SBICAP Securities demat account charges 2020.

Charges Explained

-

Securities / Commodities Transaction Tax : Tax by the government when transacting on the exchanges. Charged as above on both buy and sell sides when trading equity delivery. Charged only on selling side when trading intraday or on F&O.When trading at TRADE SMART Online STT/CTT can be a lot more than the brokerage we charge.

-

Transaction/Turnover Charges:Exchange transaction charges + Clearing charges. Charged by exchanges (NSE, BSE,MCX) and clearing member.

-

Call & trade:Additional charges of Rs10 per executed order:

-

Stamp charges: Charged as per the state of the client's correspondence address.

-

GST:Tax levied by the government on the services rendered. 18% of ( brokerage + transaction charges)

-

SEBI Charges:Charged at Rs.15 per crore by Securities and Exchange Board of India for regulating the markets.

Free Equity Delivery Trading and Mutual Funds

- Brokerage-free Equity Delivery and flat Rs 20 per trade for Intraday & F&O +

- Brokerage-free Direct Mutual Fund investment +

- Trade with the best trading platform in India.

This is a limited-time offer. Open Instant Zerodha Account online and start trading today.

0 Comments