Charges which you need to Pay for Trading in Stock Market

There is a number of charges involved while trading in India i.e. buying or selling of shares. Some of them are common like brokerage charge & STT, while there are many whom the investors are not aware of. In this article, we are going to explain all of the different charges on share trading. This typically includes:

- Brokerage Charges /Fees

- Securities Transaction Tax (STT) / Commodity Transaction Tax (CTT)

- Transaction Charges (Stock Exchange + Clearing Member)

- GST

- SEBI Charges

- Stamp Duty

- Depository charges.

- AMC or Opening charges

- Income Tax

Brokerage Fees:

This is the biggest charge which you need to pay while transacting in the stock market but now a day's because of discount brokers these charges have been reduced considerably.

Brokerage fees would depend on many variables, like the type of your Broker (Full-Service Brokers, Discount Broker), Type of Trade (Delivery based, Intra-Day trading, trading in Futures, Options).

- Typically brokerage fees charged by the full-service brokers (ICICI Direct, HDFC Securities, Sharekhan, Motilal Oswal) would be higher than the Discount Brokers (Zerodha, Upstox, Pro-stock) as they also provide a lot of other services like research and advisory, tips on stock, etc and would normally charge in % to trade. In general, a full-service broker charges between 0.01% - 0.50% brokerage charge on Intraday and delivery trading.

- The discount brokers charge a flat fee (fixed fee of Rs 10 or Rs 20 per trade) irrespective of the order value on intraday and delivery trading. There are some discount brokers who do not charge any fee on delivery trading (like Zerodha, Upstox).

- It is worthwhile to note that brokerage charges would need to be paid at both times of trading i.e. while buying a share and selling a share.

- Intraday Trading would typically attract lesser brokerage charges v/s Delivery trading but it is worthwhile to note that some discount brokers are offering the delivery trading at Zero brokerage like Zerodha, Upstox, etc.

Security Transaction Tax (STT):

Transactions that you do in the stock market attract Security transaction tax levied by the GOVT.

- Intraday & F&O Trades: STT is charged only on the sell-side.

- For delivery trading: STT is charged on both sides (buy & sell) of trading.

- Bonds, Currency, and Mutual funds: No STT.

|

Trade |

Security Transaction Tax |

|

Equity Delivery |

0.1% on buy & sell |

|

Equity Intraday |

0.025% on the sell-side |

|

Equity Futures |

0.01% on sell-side |

|

Equity Options |

0.05% on the sell-side (on premium) |

|

Currency Futures/Options |

No STT |

|

Commodities Futures |

0.01% on sell side (Non-Agri) |

|

Commodities Options |

0.05% on sell-side |

Transaction Charges:

- These charges are basically charged by the stock exchanges. Transaction charges are charged on both sides of the trading (buy & sell ) and are the same for both intraday & delivery.

- The national stock exchange (NSE) charges a transaction fee of 0.00325% of the total amount.

- Bombay stock exchange (BSE) charges a transaction fee Flat Rate per Trade Rs. 1.50. * Transaction charges for group A, B, and other non-exclusive scrips at a flat rate on a trade count basis. Existing 275 per /cr, If the scrip is exclusive.

|

Segment |

NSE |

BSE |

|

Equity Intraday |

0.00325% on Turnover |

Rs.1.50 each on buy trade & sell trade |

|

Equity Delivery |

0.00325% on Turnover |

Rs.1.50 each on buy trade & sell trade |

|

Equity Futures |

0.0021% on Turnover |

Rs.1.50 each on buy trade & sell trade |

|

Equity Options |

0.053% on Turnover |

Rs.1.50 each on buy trade & sell trade |

|

Currency Futures |

0.00135% on Turnover |

NA |

|

Currency Options |

0.044% on Turnover |

NA |

|

Commodities Futures |

Non-Agri: 0.0036% |

|

|

Agri: 0.00275% |

||

|

Commodities Options |

0.05% on the sell-side |

|

GST:

The tax levied by the government on the services rendered would be charged @ 18% of (brokerage + transaction charges).

SEBI Charges:

Charged at Rs.15 per crore by Securities and Exchange Board of India for regulating the markets.

Stamp Duties:

Effective from 1st July 2020, The GOVT of India has implemented the changes in the Indian stamp act 1899, The said amendment broadly provide for a centralized mechanism for the collection of stamp duty on securities market instruments in a single place, via one agency, and at unified rates across India, with an appropriate allocation of the tax revenue between the state governments based on the registered office/residence of the ultimate purchaser.

Key Features of new stamp duty amendment

- Unified rates across India

- All mutual fund transactions are liable for stamp duty with standardized charges across states.

- Stock exchanges act as collecting agents for secondary market transactions in securities, while depositories collect stamp duty in respect of all off-market transactions and the initial issuance of securities in a dematerialized form.

- Stamp duty is payable either by the purchaser or the seller on a transaction and not both

Unified Stamp duty on Security transactions in India

The stamp duty rates applicable to the various types of security transaction are as follows:

| Type of Security | Rate (%) |

|---|---|

| Debentures-Issue | 0.005% |

| Debentures-Transfer and reissue | 0.0001% |

| Shares -Issued | 0.005% |

| Equity Delivery Trade | 0.015% |

| Intraday Trades | 0.003% |

| Futures (equity and commodity) | 0.002% |

| Options (equity and commodity) | 0.003% |

| Currency and interest rate derivatives | 0.0001% |

| Other derivatives | 0.002% |

| Government securities | Nil |

| Repo on corporate bonds | 0.00001% |

Who is responsible for the payment of stamp duty on security transactions?

The below table helps you to find out who is responsible for the payment of stamp duties:

| Type of transaction | Payee |

|---|---|

| Sale of security through the stock exchange | Purchaser |

| Sale of security other than through a stock exchange | Seller |

| Transfer of security through a depository | Transferor |

| Transfer of security other than through a stock exchange or depository | Transferor |

| Issue of security | Issuer |

| Any other instrument not specified | Person making, drawing, or executing such instrument |

Depository Participant (DP) Charges:

- NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited) are the two stock depositories in India.

- Whenever you buy a share, it is kept in a digital form with the depository. These services provided by the depositories are chargeable and they normally charge some fixed amount for that.

- Individual investors can not directly go and open an account with these depositories, they would need to open an account with the depository participant. Here, the brokerage firm / Bank where you have opened your Demat account would work as the depository participant (DP).

- DP acts as an interface between the depository and stock market as the investors cannot approach the depository & Stock market directly. So, overall the depository would get money from the depository participant, and then the depository participant (DP) would get money from the investors.

- DP charges are usually flat of between Rs 10 to 35 depending on your broker and this is also charged only for delivery trading (not for intraday or derivative).

Account opening & AMC charges:

Trading Account / Demat opening charges are a one-time fee that Broker would charge to initiate your account opening process. Trading /Demat AMC (Annual maintenance Charges) is an annual fee charged by Brokers to maintain your account, this is annual charges and would be getting deducted from your account even if you haven't traded for a year. All these charges would vary from broker to broker.

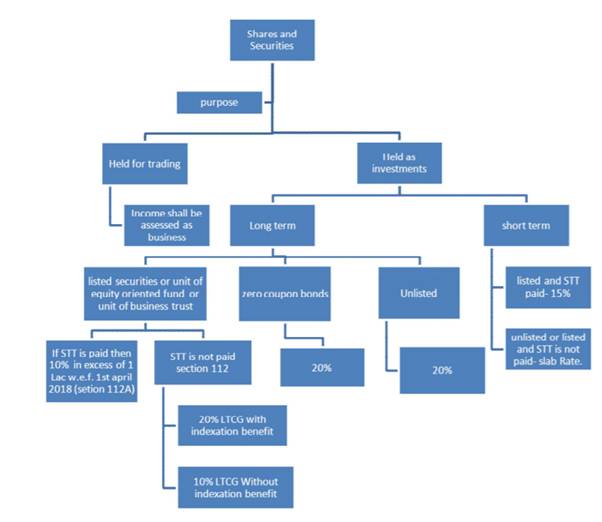

Income Tax:

According to the Income Tax Act, these transactions are separately assessed under different heads depending on the nature, quantity, and purpose of entering into these transactions.

For example, if a person intends to hold shares for investment purposes then it will be assessed under the head Capital Gains however if a trader deals in financial instruments it will be assessed as Business Income. Intraday termed as speculative business Income, Derivatives trading also termed as normal business income. If you do the delivery-based trading then the below-mentioned chart would explain tax treatment.

0 Comments