CompareShareBrokers Latest Blogs (95)

Zerodha-Number One Broker in India

For Indian resident Zerodha charges a brokerage of 0.03% or Rs.20 per executed order, whichever is lower, irrespective of the number of shares or their value (other than equity delivery trade which is free).Zerodha doesn't have minimum brokerage and maximum brokerage you pay for any transaction is Rs.20 for an order (of any size and in any segment).

Fund transfer to Zerodha using UPI

National Payment Corporation of India (NPCI) has developed an instant payment system built over existing IMPS infrastructure called UPI or Unified Payments Interface. This allows you to instantly transfer funds between any two parties’ bank accounts.UPI transfers can be used from any bank account. You can transfer a maximum of Rs. 1 lakh per day using UPI.

Brokerage Free Stock Trading

Some brokers offer the Brokerage free delivery trade as part of their basic plans like Zerodha, Dhani Stocks, Angel One, etc and some brokers offer the same if you enroll for their subscription plans like 5paisa.

IIFL Super Trader Plan

IIFL Super Trader Plan (Pro Traders) which provides an opportunity to invest in the stock market at competitive rates and is been designed for the trader community who wants lower brokerage along with a host of services. This plan can be subscribed by paying monthly subscription charges of Rs.999

Groww Broker review and Brokerage Charges

Groww was launched in 2017 by former Flipkart executives Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal. Groww started as a platform for buying direct mutual funds. Currently, It has over 6 million registered users and caters to investors across more than 800 cities. It is backed by some of the marquee investors, which include Sequoia, Ribbit, YCombinator and Mukesh Bansal, among others.

IIFL Investor Plan

IIFL has recently launched 3 new Brokerage Plans designed for different-different customer profiles. Investor Plan (Online Plus), Super Trader Plan (Pro Traders), and Premium Plan (Dedicated RM). You can choose any of the plans bases on your need while opening the demat account or any time after that as well. Here we would be discussing Investor Plan (Online Plus).

Call and Trade Charges

Currently, there are many ways in which you can buy and sell your securities like via mobile app, HTML based trading platform, trade terminal, or install-able desktop software, and via calling to brokers executive but before the online broking era, the customers were inclined towards making calls to their brokers and making purchases of their securities.

Edelweiss Lite Brokerage Plan 2020

To compete with increased competition from discount brokers Edelweiss has also launched a new Brokerage Plan Edelweiss Lite which provides an opportunity to invest in the stock market at flat Rs.10/ order for all segments.

Best Technical Analysis Software in India

Here we are going to talk about some of the best technical analysis software in India, best charting software for Indian markets, best trading software in India.

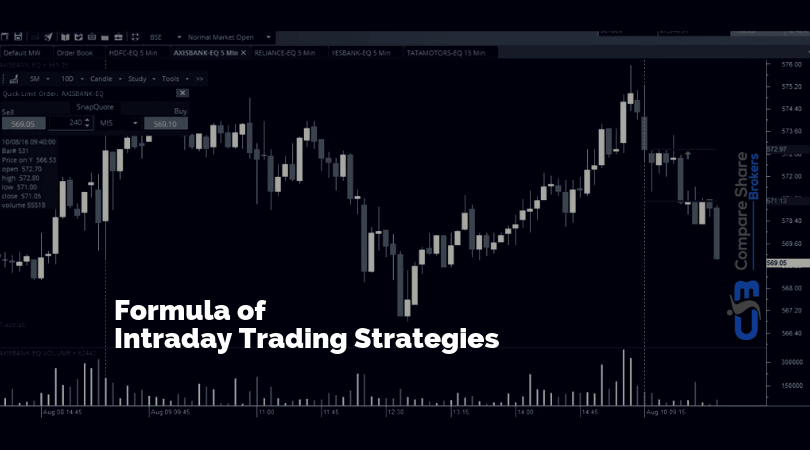

Intraday Trading Tips, Strategies and Formula

Most of Intraday traders work on High leverage / Margin provided by the brokers which might result in to huge loses unless they follow strict money management and should not trap in to more and more trades , the ideal way is to make as much less trades as possible using best trading techniques or strategies.