Income Tax on Share Trading

Share trading has become very prevalent in India and many taxpayers hold some of their investments in shares. In this article, we look at the applicability of income tax on share trading in detail for 2018-2019(The assessment Year 2019-2020)

The traders or investors enter into different types of transactions on the Stock exchange which includes Delivery based transactions, Intraday trading, and trading in derivatives (futures, options).

- Delivery based transactions When a person purchase a financial instrument like shares and hold them overnight it is called delivery based transactions.

- Intraday trading- As the name suggests, Intraday means the purchase and sale of financial instruments within the same day, the gains/losses are squared off before the closing bell.

- Derivatives- Financial instruments like futures and options are traded in derivative market.

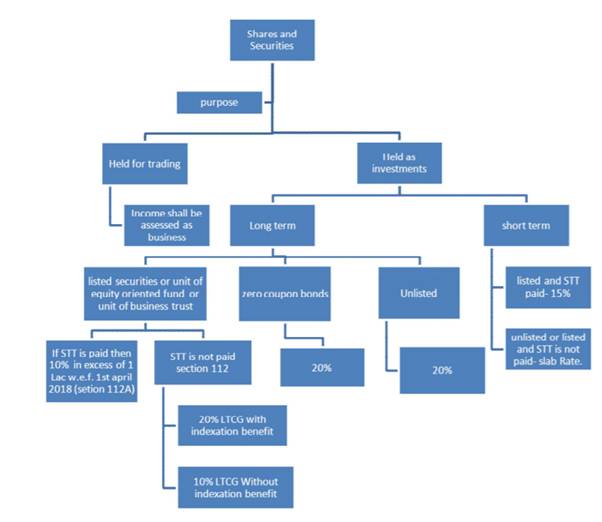

According to the Income Tax Act, these transactions are separately assessed under different heads depending on the nature, quantity, and purpose of entering into these transactions.

For example, if a person intends to hold shares for investment purposes then it will be assessed under the head Capital Gains however if a trader deals in financial instruments it will be assessed as Business Income.

Let us understand the tax treatments of the above-mentioned transactions in detail

Income Tax on Intraday Trading (Non- delivery based)

It is treated as a Speculative transaction as per section 43(5) of the Act since the main purpose of the trading in intraday is speculation. The Income from the speculative transaction is taxable under the head " Income from business". The loss from such trading is to be set off against the Profits from such trading business only and not against any other businesses.

Also, the provisions of Section 44AB will be applicable. As per section 44AB, a person carrying on a business whose *turnover exceed 1 crore shall be liable to carry on a Tax audit.

The question here is how to calculate turnover? While calculating turnover, profit/loss booked through Increased/decreased value is to be added/deducted. Here the contract is settled otherwise and squared up by paying out the difference which may be positive or negative. As such, in such transaction the difference amount is called as 'turnover'.

Income Tax on Delivery based transactions

If the investor purchases shares (equity or preference) which are listed in a recognized stock exchange, units of equity-oriented mutual funds, listed securities like debentures and Government securities, Units of UTI and Zero-Coupon Bonds, and hold it up to 12 months then it will be regarded as Short term capital Asset and short term capital gains/ loss shall be assessed under the head Capital Gains. However, if the investors hold the above instruments for more than 12 months then it will be regarded as long term capital asset and long term capital gains/ loss shall be assessed under the head Capital Gains.

The classification of shares as trading or investment has become the subject matter of dispute between the assessee and tax authorities. The tax authorities try to bolster their view by treating it as business and charge it to tax @ 30% apart from denying indexation, however, assesses objects to this view taken by tax authorities by claiming that income has to be taxed as Capital Gains @ 15% in case of short term or 10% in case of long term capital assets. Thus, the basic premise for the classification of capital gains versus business income will be based on the concept of " significant trading activity". If the portfolio is churned frequently then the income shall be classified as " Business income". The ratio of purchases to sales is also a criterion. If the magnitude of purchases and sales is analogous then it is a pure sign of trader and therefore it will qualify as " Business Income".

Income Tax on Trading in derivatives (futures and options)

Trading in futures & options must be reported as a business Income unless you have only a handful of trades in the financial year.

Remember this also applies to individuals. You don’t have to be formally incorporated as a company or some legal entity to earn business income. Individuals can have business income too and have to file ITR-3 to report F&O trading income/losses. Reporting an activity as a business income means that you can claim also expenses from earnings of your business.

The bright spot in filing your return as a business Income is being able to claim what you’ve spent on it. Sometimes claiming expenses can lead to a business loss and that is ok too as you can carry forward the business losses to next years and get a tax benefit. You should only claim expenses that have been directly and exclusively spent on business activity. Brokerage, broker’s commission, subscriptions to journals related to trading, telephone bills, internet costs, consultant charges if you engaged a person, or took advice from a professional who charged you. Or the salary of a person you hired to help with your business. All of these can be claimed. You need to be careful to maintain a proper record of receipts/bills and make sure you are spending via cheques or bank transfers and not in cash. Expenses over Rs 10,000 in cash may not be allowed to be claimed.

The most important reason to file a return with F&O trading is to be able to benefit from losses you have incurred. If your business resulted in a loss, don’t worry, report it in your tax return. It would be adjusted from income from remaining heads such as income from other businesses, rental income, or interest income (cannot be adjusted from salary income) if any. Any unadjusted loss can be carried forward for eight years. However, in the future, they can only be adjusted from non-speculative income. It is worthwhile to note that F&O trading Profit or loss is considered a non-speculative Profit or loss but Intra-day stock trading is considered as a speculative and hence the losses arising out of it can only be adjusted against speculative income. Unadjusted speculative losses can be carried forward to four years only.

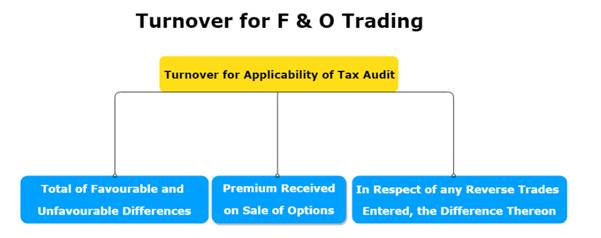

Please also note that if your turnover exceeds 1 Crore Audit of accounts would be mandatory.

Turnover for the purpose of determining whether tax audit is applicable to F & O Trading or not is calculated a little differently. Read on

Here, it makes no difference, whether the difference is positive or negative. All the differences, whether positive or negative are aggregated and the turnover is calculated.

Conclusion - In our view, classification of income under the various heads of Income has been subject matter of scrutiny and availability of proper documentation supported with the Intention would be key in deciding the head of income.

0 Comments