What is Proprietary Trading

When an organization uses his own capital to trade in a security market called proprietary trading, also popularly known as prop trading. Normally Brokerage firms, an Investment bank would carry out such kind of transactions to maximize the profit as it allows a firm to earn full profits from a trade rather than just the commission it receives from processing trades for clients. These trades often deal in derivatives or other complex investment vehicles and are usually speculative in nature.

Sophisticated software and pools of information are being used by Proprietary traders to help them make critical decisions.

Prop trading is an important source of revenue for such institutions. For example institutions like Goldman Sacs, JP Morgan, Bank of America, etc all have internal teams that handle the Prop Trading desk.

What are the Pros & Cons if you have an account with a stockbroker who also does Prop Trading?

Pros:

- Sophisticated software and pools of information are being used by Proprietary traders to help them make critical decisions.

- In general, the training provided by these firms is much more hands-on and valuable.

- As they do the trades themselves and would have more practical knowledge of the stock market and retail investor would also get the benefit of that experience.

Cons:

- If market swings unexpectedly, technical issue happen or manual mistakes made prop trading desk may result into very heavy losses and would impact their ability to full fill their obligation.

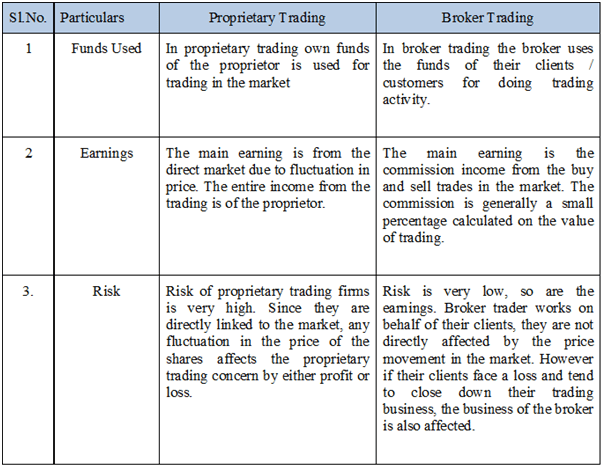

What is the difference between a broker (Retail) trading and proprietary trading?

0 Comments